What’s the difference between leasing and buying solar panels?

Thinking about getting solar panels on your roof? Here’s what you need to know about the pros and cons of leasing a solar panel system and buying one.

Going solar is a great way to lower your monthly electric bill and reduce your carbon footprint. The good news is that you have options for how to get solar for your home. If you have enough money for a down payment and want to see more savings over time, then buying a solar panel system might be the right move for you. If purchasing a solar system isn’t in the budget, however, you can still probably benefit from leasing a solar panel system or entering a solar power purchase agreement (PPA).

Let’s dive into the details of leasing vs. buying solar panels so you can decide what’s best for your home.

In this article:

- How solar leasing works

- How buying solar panels works

- Pros and cons of leasing vs. buying solar panels

- Solar costs & savings comparison

- Additional considerations for leasing vs. buying solar panels

- The bottom line

- Frequently asked questions

How solar leasing works

According to market research, more than half of installers say that customers are turning to third-party ownership (TPO) models like leases and power purchase agreements (PPAs). Solar leasing involves less upfront cost than ownership. And because you don’t own the system, you’re not responsible for any system maintenance or replacement costs.

In a solar lease, you pay a monthly fee for the use of a solar panel system that a utility or an installer owns. Think of it like a rental: The solar panels are installed on your property, but you don’t own them. Instead, you’ll pay a flat monthly fee for the use of the solar system. And you get all the power it produces.

A power purchase agreement, or PPA, is similar to a traditional solar lease: You don’t own the solar panels, and there are monthly payments involved. But instead of paying a flat monthly fee, you pay for the electricity that the panels generate. The cost of the electricity is priced on a kilowatt-hour (kWh) rate, and at a discount compared to what you’d pay for electricity from the utility — and you only pay for the electricity you use.

Solar leasing contract terms

A solar lease contract usually lasts at least 20 years, or between 10 and 25 years for a PPA — quite a commitment! Just like with any type of contract, it’s important to read the fine print before signing anything. Here are a few key terms to look for in a solar lease:

- Escalators: Escalators are increases to your monthly payment that could happen over the duration of your lease. They usually aren’t anything too shocking (between 2% – 5%), but they can add up over time.

- Performance guarantees: This is the leasing company’s promise that your solar panels will produce a certain minimum amount of electricity. It’s a way to make sure your solar panels are producing electricity at the rate they’re supposed to.

- Early termination terms and fees: These are fees you’ll have to pay if you wish to exit the lease before your contract officially ends. If you plan on moving or selling your house in the future, the leasing company might want you to pay out the remaining balance of the lease.

How buying solar panels works

Buying a solar panel system means you own it. You’ll likely save more money over time than you would with a solar lease, and you’ll qualify for federal and state financial incentives. The downside is that the upfront costs are generally higher, and you’re responsible for the upkeep and maintenance of the solar system.

When buying a solar system, you have two options: You can pay upfront in cash or finance it. If you can afford it, paying in cash may be your best option. There are no financing fees or interest involved, and you’ll qualify for federal and state tax incentives.

But because solar can be a big investment, most people opt to finance. There are a few common options for financing a solar system — and they all let you claim the financial incentives you qualify for when buying a system. The first option you’re likely to come across is solar loans. These are loans offered by the solar company installing your panels. You could also consider a personal loan from your bank or open a home equity line of credit (HELOC). Just note that if you choose to go with a HELOC, your home becomes collateral. It’s important to consider all your options and compare fees and interest rates before making a final decision.

Solar financial incentives

One of the biggest benefits of choosing to buy your solar panels is that you can take advantage of federal and state financial incentives. These incentives are typically in the form of tax credits, rebates, and certain tax exemptions. Here are some of the most common solar incentives you’ll come across:

- Federal solar tax credit: By far, your biggest financial incentive to go solar is the federal solar tax credit that allows you to claim up to 30% of the total cost of your solar panel system on your federal taxes. This incentive is ending at the end of 2025, so now is the perfect time to take advantage of it.

- State tax credits: Some states offer their own tax credits for homeowners who go solar. These are typically offered as state income tax credits that offset the cost of your solar system up to a specific amount. For example, New Mexico offers a state tax credit of up to 10% of the cost of a solar panel system, but it’s capped at $6,000.

- Net metering: Net metering programs allow you to sell any excess electricity generated by your solar panels to the power grid. These programs are usually run by state and local electric utilities, and you’ll either be compensated in cash or with credits on your electric bill.

- Property tax exemption: Installing solar panels increases the value of your home, so they could increase the amount you pay in property taxes. But if your state has a residential solar property tax exemption in place, you won’t have to worry about your solar panels increasing your annual property taxes.

- Sales tax exemption: A solar sales tax exemption simply means you won’t be charged sales tax for your solar panel system.

Pros and cons of leasing vs. buying solar panels

Here’s a recap of the advantages and disadvantages of leasing vs. buying.

| Pros | Cons | |

| Leasing | Little to no upfront costs You’re not responsible for system maintenance Save money on your electricity bill | Ineligible for most solar tax credits and rebates Your monthly payments could escalate Lower long-term savings Potential complications when selling your home |

| Buying | You qualify for federal and state incentives Greater long‑term savings Increased property value | Higher upfront costs You’re responsible for system maintenance |

Solar costs & savings comparison

Whether you plan to lease or buy a solar panel system, it’s important to know exactly what you’re in for. But solar panel pricing is tricky — there’s no one-size-fits-all cost. The price you pay depends on things like the size of the system, the condition of your roof, the types of equipment installed, financial incentives, and even your geographical location. To get the most accurate solar quote for your home, you’ll need to speak with an installer. However, we can provide an estimated range for the sort of pricing you can expect to see.

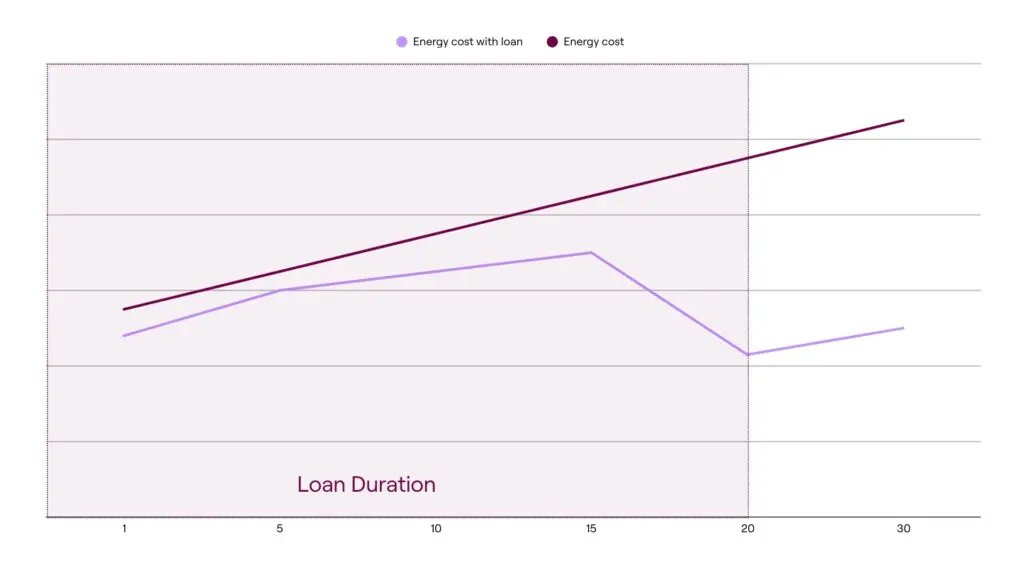

Solar loan: typical monthly savings

Solar loans are typically set over 10 to 20 years with monthly payments sent to banks, lenders, or solar financing companies — and are one of the easiest ways to pay for solar. And once the loan is paid off, your savings really jump.

- Upfront cost: Low

- Monthly savings: Medium

- Payback period: Medium

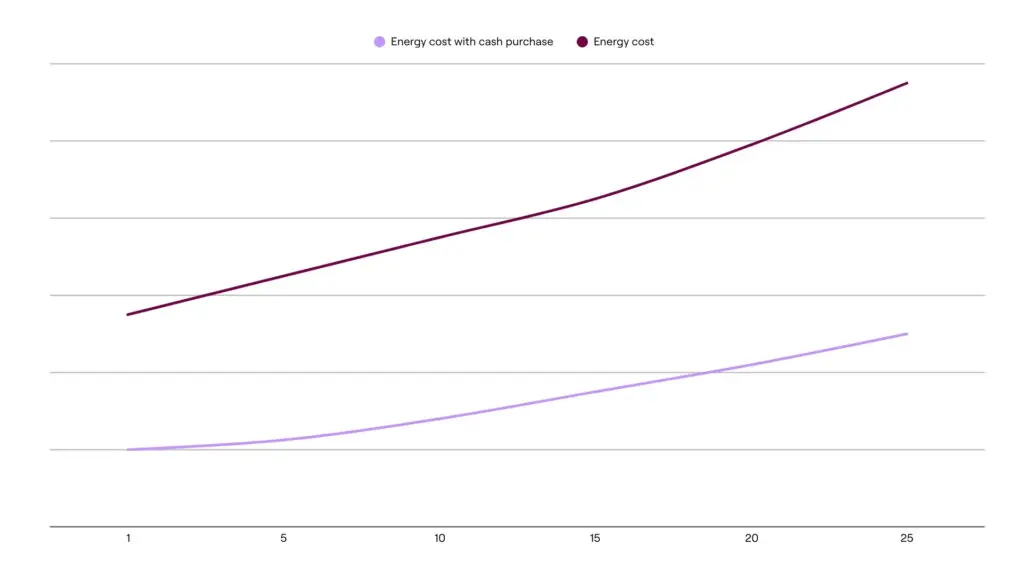

Cash

The average cost of buying a solar panel system is $26,880. This price factors in savings from the federal solar tax credit (which ends at the end of 2025).

- Upfront cost: High

- Monthly savings: High

- Payback period: Short

Third-party ownership

Third-party ownership (TPO) — i.e. a solar lease or PPA — requires no upfront investment. According to our research, over 50% of installers said TPO was the first choice for financing solar projects, but only about 20% of homeowners interested in solar said the same thing.

- Upfront cost: Zero

- Monthly savings: Medium

- Payback period: N/A

The better option really depends on your financial situation. You’ll typically see more savings if you choose to buy your solar panels versus signing a lease. And since you own the system, you’ll eventually see a return on your investment, with the average solar payback period landing between 4-10 years. But the upfront costs of buying can be significant, and that might not work for your current budget. A solar lease promises low upfront costs, sometimes even as low as $0.

Explore our Homeowner Snapshot for more information on different solar incentives and financing options.

Additional considerations for leasing vs. buying solar panels

Homeownership horizon

Got plans to move soon? A solar lease could complicate things. Ideally, you can transfer your lease to the new homeowner. But if that’s not an option, you could be subject to early termination fees and may have to pay out the remaining balance of your lease.

Buying a solar panel system makes moving less of a hassle. You own the system, so it can be sold with the rest of the property. Solar panels are also seen as a home upgrade, so you may see an increase in your home’s resale value.

Maintenance & performance risk

One of the best parts about leasing a solar panel system is that you don’t have to deal with any system repairs or maintenance. All those costs fall to the leaseholder. It’s like renting a house or an apartment; when something breaks, you call the landlord. But when you own the solar panel system, those maintenance costs, while typically minimal, are now your responsibility.

System upgrades & technology

Owning a solar panel system means you can upgrade and modify it as you please. Maybe you’d like to add a solar battery to store electricity in case of a power outage. Or maybe you’re thinking about adding more panels to your solar array in the future. Unfortunately, if you’re in a solar lease, you’ll have to take these conversations up with the leaseholder.

The bottom line

Solar has great benefits, no matter if you choose to lease or buy your own panels. Either way, you’ll likely see savings on your electric bill and know that you’re supporting renewable energy. Buying your own solar panel system means more savings, and you’re eligible for financial incentives. If you don’t have the cash, however, a solar lease can be a quick, low-cost way to go solar.

A trusted solar installer can help you figure out which financing option works best for your situation.

Aurora Solar makes it easy to connect with multiple vetted local installers and compare quotes all in one place. That way, you can feel confident you’re choosing the right provider and financing option for your home and budget. Get started here.

Frequently asked questions

Can I access tax credits if I lease?

The short answer is no. Only the owner of the solar panel system is eligible for any tax credits or incentives. If you’re leasing a system, that means the leaseholder is the one who claims any financial incentives for the system.

Can I sell my home with a leased system?

You can sell your house with a leased system on the roof, but it can make things a bit trickier. The ideal scenario is that the home buyer wants to keep the solar panels on the property and therefore doesn’t mind taking over the lease — and passes any checks that the leaseholder has in the contract. If not, you’ll likely be subject to early termination fees and may even have to pay out the rest of what you owe.

When does buying make financial sense?

Buying a solar panel system makes the most sense if you can afford the down payment and monthly financing costs. If you’re not buying the system outright, you’ll want to make sure that you qualify for a loan, either through the solar company or your bank. If you don’t have the funds for larger upfront costs, then a solar lease might be a better option.

Can I switch from lease to purchase?

Yes, it’s possible for your lease to turn into ownership of the system, but it depends on the terms of your lease and the policies of the leaseholder. Some companies will allow you to “buy out” the lease after a certain amount of time has passed, effectively transferring ownership of the system over to you. Talk to your leaseholder for the terms and conditions of your specific lease.

Is there a break-even for leasing?

Since you don’t own the system, and likely didn’t get an all-in price in your contract like you would if you were purchasing it, calculating your breakeven point for a lease can be a little more complicated. It’s easier to look at your bill savings every month. But, you can calculate the total amount you’ll pay in lease payments and other fees, then add up monthly bill savings to get an idea. An expert solar installer will have tools that let them show you total savings over time for any financing option you choose.